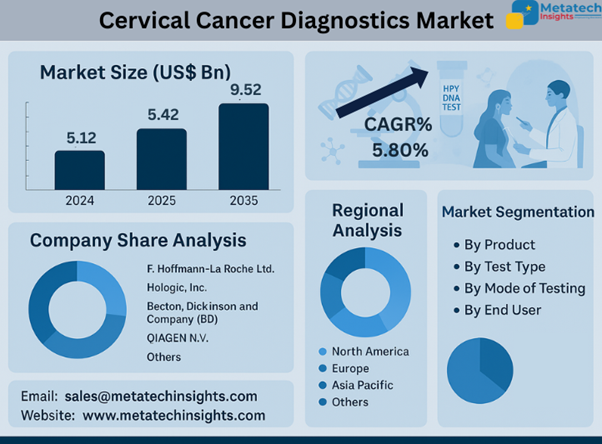

Global Cervical Cancer Diagnostics Market to Hit USD 9.52 Bn by 2035 | CAGR 5.80%

09 Aug 2025 | Report ID: MI3271 | Industry: Healthcare | Pages: 220 | Forecast Year: 2025-2035

Read more about this report- Global Cervical Cancer Diagnostics Market to Hit USD 9.52 Bn by 2035 | CAGR 5.80%

The Cervical Cancer Diagnostics Market is valued at USD 5.12 billion in 2024 and USD 5.42 billion in 2025.

The Cervical Cancer Diagnostics Market will achieve USD 9.52 billion by 2035 through a projected 5.80% CAGR from 2025 to 2035.

The Cervical Cancer Diagnostics Market has been growing tremendously due to the high number of globally increasing cases of cervical cancer, awareness of early screening, and development of diagnostic technology. International governments are pumping money into national screening as the health systems move towards an early diagnosis and prevention regime. All these are increasing the pressure for accessible and precise diagnostic instruments in the health of women.

Products in the market include Pap smear kits, HPV test kits, biopsy forceps, speculums, and colposcopes. Back in the olden days, Pap smear kits were the order of the day, but HPV test kits are becoming adopted since they are more sensitive as far as the identification of cancer-causing strains of HPV is concerned. Equipment such as colposcopes and biopsy instruments is crucial in the confirmation of diagnosis, particularly in specialized gynecology and oncology clinics.

Pap tests, HPV DNA tests, visual inspection with acetic acid (VIA), and biopsy & colposcopy procedures form methods of diagnosis. DNA HPV screening is replacing the test in most developed nations as the major choice of screening because of its reliability and decreased frequency of testing. VIA is still needed in low-resource areas due to its low cost, whereas biopsy-based diagnostics play a significant role in the disease progression confirmation.

The dominant mode of testing in the lab is lab-based diagnostics because they are precise and have extensive analysis in hospitals and centralized blood labs. Nonetheless, the use of point-of-care testing is cropping up in underserved and rural locations. Self-sampling kits, mobile diagnostic services, and telepathology solutions that facilitate the screening of cervical cancer are becoming widespread and affordable.

The market has various end users, such as hospitals, diagnostic labs, home care, and research centers. The majority of the hospitals and clinics are on the front line because of the availability of the infrastructure and government backing. HPV testing and cytology are provided centrally in the diagnostic labs. In the meantime, the development of at-home test kits is promoting self-screening. The majority of research centers are developing new methods to achieve higher accuracy of diagnosis using biomarkers and online tools.

Several forces are enhancing the market growth, which include the creation of awareness about cervical cancer globally, cervical cancer national screening programs, and cost-effective microsurgery tests. Gap areas of preventative care in women emerged through the COVID-19 pandemic and led to policy attention and investment. Newer technologies, such as AI-enabled colposcopy, liquid-based cytology, and multiplex molecular testing, are improving the speed and individualization of diagnosis.

The leading North American countries are also the leaders in terms of infrastructure, awareness, and speed of technology adoption. Conversely, the fastest-growing region is Asia Pacific, due to increased investment in the sector and increased coverage of healthcare through screening, along with government-initiated programs that focus on women's health. Worries about hybrid screening models and awareness programs are widely being invested in by India, China, and Japan.

Key competitors who are giving form to the market would be F. Hoffmann-La Roche Ltd., Hologic, Inc., Becton, Dickinson and Company (BD), and QIAGEN N.V. Such players are targeting automated systems, digital pathology platforms, and scalable diagnostic models. They involve international partnerships, penetration of emerging markets, and more patient-friendly and affordable production of technologies that work in the detection and prevention of cervical cancer.

Maximize your value and knowledge with our 5 Reports-in-1 Bundle - over 40% off!

Our analysts are ready to help you immediately.