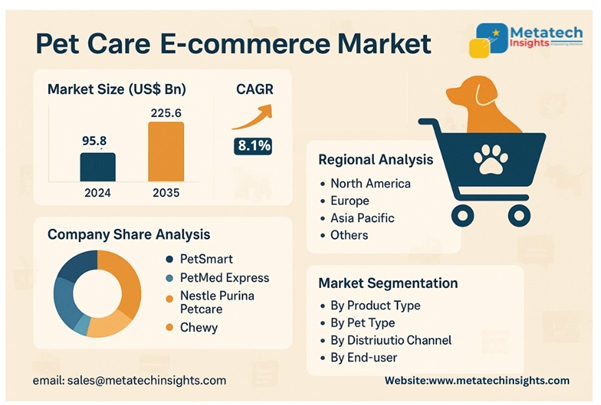

Global Pet Care E-commerce Market to Hit USD 225.6 Bn by 2035 | CAGR 8.1%

08 Aug 2025 | Report ID: MI2165 | Industry: Pet Care | Pages: 210 | Forecast Year: 2025-2035

Read more about this report- Global Pet Care E-commerce Market to Hit USD 225.6 Bn by 2035 | CAGR 8.1%

Metatech Infographics: Smart Data, Market Segments & Future Trends at a Glance

The Pet Care E-commerce Market was valued at USD 95.8 Billion in 2024 and is projected to reach USD 225.6 Billion by 2035, growing at a CAGR of 8.1% between 2025 and 2035. This market growth is largely driven by the rising importance of pet visibility and safety during outdoor activities, increasing pet ownership, and growing involvement of dogs in service, adventure, and working environments.

The Pet Care E-commerce Market is being faced with a vigorous speed-up with a growing digitalization tendency and improvement in popularity of the idea of convenience among pet owners. The online sales of pet food, grooming products, healthcare products, and accessories tend to gain even more popularity, and the variety of products, quick shipping, and subscriptions can be considered as the main factors. The digital buying experience is further being boosted through personalized product recommendations and rewards programs.

In product segments including pet food, treats, healthcare products, grooming kits, toys, wearables, and insurance or wellness subscription services, the consumers prefer to choose a reliable platform where the detailed description of a product is given, and where positive reviews about the product are reviewed with the help of verified customers, and the recommended products are selected by the professionals. Wellness-related SKUs, in general, and nutritional transparency, in particular, are becoming more popular.

The preference for types of pets differs greatly, where dogs and cats take the computer sales pole position, with birds, aquatic pets, and small mammals buying are growing steadily. A niche that is also setting in is on reptile and amphibian care products, particularly in developed market areas that are developed.

Consumers will range between individual pet owners, veterinary clinics, grooming service providers, and shelters. Whereas people commonly expect regularly delivered goods and special deals, institutions need the possibilities of bulk purchasing, product validity, along with services like consultation or diagnostic/ subscription diagnostics.

The presence of online retailers and marketplaces that include Amazon, Walmart, and Chewy, in both scale and reach, is in contrast to Direct-to-Consumer (DTC) brands and subscription-based businesses driven by well-curated product offerings, including the likes of BarkBox and The Honest Kitchen, that are gaining dedicated fanbases. These are brands that stand out in the aspects of transparency, eco-packaging, and modular pet solutions.

North America is expected to dominate the worldwide Pet Care E-commerce market because of the high digital penetration, the developed culture of pet ownership, and its readiness to spend on pet wellness. Europe comes behind not-so-long and robust development in Germany, the U.K., and France. China, India, and Australia are the fast-emerging economies in the e-commerce business in the Asian Pacific region, due to the increasing disposable incomes and urbanization trend of pet parents.

Strategic partnerships, the digitalization of the experience of customers and same-day delivery, AI-driven suggestions, and even subscriptions are on the radar of leading players such as PetSmart, Nestl Purina Petcare, Chewy, Petco, Amazon, PetMed Express, Zooplus, and Pets at Home. These players are staying competitive with the help of loyalty programs, mobile app interface, and collaboration with veterinary telehealth.

Maximize your value and knowledge with our 5 Reports-in-1 Bundle - over 40% off!

Our analysts are ready to help you immediately.