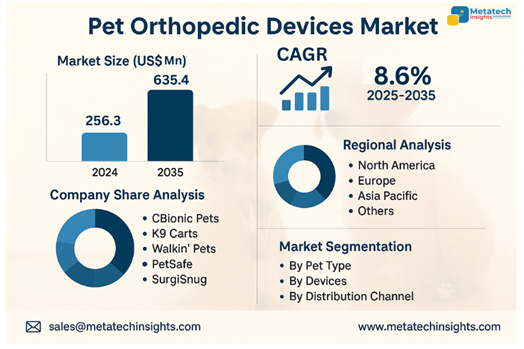

Global Pet Orthopaedic Devices Market to Hit USD 635.4 Mn by 2035 | CAGR 8.6%

09 Aug 2025 | Report ID: MI1132 | Industry: Pet Care | Pages: 225 | Forecast Year: 2025-2035

Read more about this report- Global Pet Orthopaedic Devices Market to Hit USD 635.4 Mn by 2035 | CAGR 8.6%

Metatech Infographics: Smart Data, Market Segments & Future Trends at a Glance

The Pet Orthopaedic Devices Market was valued at USD 256.3 million in 2024 and is projected to reach USD 635.4 million by 2035, growing at a CAGR of 8.6% between 2025 and 2035. This growth is fuelled by the rising prevalence of musculoskeletal conditions in pets, increasing awareness about pet mobility care, and the growing adoption of post-surgical and therapeutic solutions by pet parents and veterinarians.

Devices categorized under this market are braces and supports (knee, elbow, ankle braces, back supports), surgical devices (implants, plates, screws, pins, external fixators), therapeutic devices (hydrotherapy equipment, laser therapy equipment, hot/cold packs), and prosthetics (limb, paw prosthetics). The market is segmented between veterinary clinics, online retail, and the pet stores channels, and, as for specialty and custom-fit orthopaedic products, there is a significant transition toward online retailing.

The choice of products would generally be pet type, injury severity, age, and lifestyle. The biggest group of this segment is dogs, as they are most likely to encounter joint injuries and arthritis. There is also an expanding orthopaedic demand for cats and other companion animals since pet humanization trends are on the rise. Light-weight designs, designs that are customizable, and non-invasive designs are preferred, more so in aging pets and during recovery post-surgically.

There is an increment of demand in smart orthopaedic products such as wearables to track movements, Internet of Things-based braces, and laser machines that people can use at home to treat pain. More vet-recommended and ergonomic solutions that make life more mobile and less stressful are also more acceptable to the pet parents. Support and prosthetic goods are made using BPA-free, sturdy, and recyclable materials, which eco-conscious buyers are opting to use.

The main consumers are individual pet owned pet owners, veterinary hospitals, animal rehabilitation centres, and animal shelters. Though the majority of the demand is based on pet parents attempting to treat chronic pain or injury, the institutional buyers are driving up growth as they implement orthopaedic support in their process of rehabilitation and wellness. Augmenting the segmental growth as well are the increased custom orthotic fabrication services, as well as mobile veterinary rehabilitation units.

North America dominates the market due to high spending on advanced veterinary care and awareness of orthopaedic solutions. Europe follows closely, driven by demand for high-quality surgical and therapeutic devices. Asia Pacific is expected to witness the fastest growth, especially in India, China, and South Korea, supported by rising pet adoption, disposable income, and increased access to veterinary care. Latin America and the Middle East are gradually expanding with urban households investing in better mobility solutions for pets.

Leading players including Walkin’ Pets, Hero Braces, OrthoPets, and KVP Orthotics are innovating with custom-fit designs, advanced surgical implants, and therapeutic technologies. Companies are emphasizing collaborations with veterinary professionals, awareness campaigns, and R&D into biocompatible materials to gain a competitive edge. The focus is on expanding product access via digital platforms and improving recovery outcomes through holistic orthopaedic care.

Maximize your value and knowledge with our 5 Reports-in-1 Bundle - over 40% off!

Our analysts are ready to help you immediately.