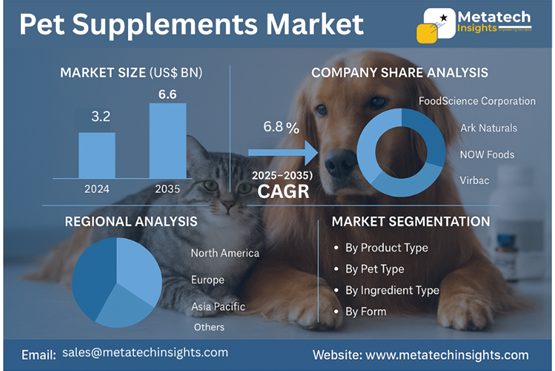

Global Pet Supplements Market to Hit USD 6.6 Bn by 2035 | CAGR 6.8%

09 Aug 2025 | Report ID: MI1127 | Industry: Pet Care | Pages: 210 | Forecast Year: 2025-2035

Read more about this report- Global Pet Supplements Market to Hit USD 6.6 Bn by 2035 | CAGR 6.8%

Metatech Infographics: Smart Data, Market Segments & Future Trends at a Glance

The Pet Supplements Market was valued at USD 3.2 Billion in 2024 and is expected to reach USD 6.6 Billion by 2035, expanding at a CAGR of approximately 6.8% between 2025 and 2035. The market’s growth is propelled by the increasing awareness of pet health and wellness, rising cases of pet obesity, digestive issues, joint disorders, and the humanization of pets. As more owners seek preventive healthcare solutions for their animals, the demand for natural, vet-recommended, and condition-specific supplements continues to surge across global markets.

There has been an increased consumer demand for pet supplements in the market to support general health and various health conditions like joint health, digestion, skin health, improved cognitive ability, and immunity. Well-liked preparations entail soft chews, liquids, powders, and pills, whereas soft chews and liquids are being popularized due to their convenient administration and taste. Natural ingredients such as omega fatty acids, probiotics, antioxidants, and herbal extracts are largely favoured due to their low profile of side effects and their natural health effects.

The selection of supplements by the pet owners is based on the type of pet available, the condition that needs to be treated, the age, and the nutritional requirements of the animal. The canine sector is dominated by joint health and digestive products, whereas multivitamins and immune support products are catching on in all types of pets. Weight management supplements, cognitive health supplements are also catching up, particularly in aging and obese pets.

The classes of customers are: Household pet owners, Veterinarians, Breeders, Rescue centers, and pet care experts. Veterinarians are important decision-makers when choosing a product, particularly functional supplements that mitigate chronic or breed-based problems. Safety, being clear about what is in the product, veterinary approval, and clinical confirmation of efficacy are part of what buyers want.

The channel of distribution is rated highly both online and offline. The reason that online pharmacies and pet e-commerce are experiencing high growth is due to the subscription option, ease of comparison, and detailed descriptions provided on the products. But the brick-and-mortar store is still crucial when it comes to pet specialty shops and vet offices, where novice buyers and advice-loving pet parents can purchase fresh pet supplies and have them professionally selected. Specialized formulations are also going directly to clinics and the breeders.

The most prevalent share is in North America, where the rates of pet ownership are high, the trend of humanization is observed, and highly developed veterinary healthcare systems exist. Europe is not far behind with a robust regulatory framework and an increase in the number of people demanding natural pet products. Asia Pacific is experiencing a steep growth, mainly in India, China, and Japan, because of an increase in disposable income, urbanization, and a rise in pet food knowledge.

The major industries, including FoodScience Corporation, Ark Naturals, NOW Foods, Virbac, and Zoetis Inc., are currently making R&D to devise novel supplement formulations with multi-purpose advantages. These entities are augmenting their product lines into these natural, organic, and vet-recommended, as well as exploiting the e-commerce and veterinarian alliances to achieve even greater customer credibility and global penetration.

Maximize your value and knowledge with our 5 Reports-in-1 Bundle - over 40% off!

Our analysts are ready to help you immediately.